A Golden Opportunity to Buy Real Estate Is Upon Us

Why It’s Time to Buy Property Again

1. Prices already softened across the country.

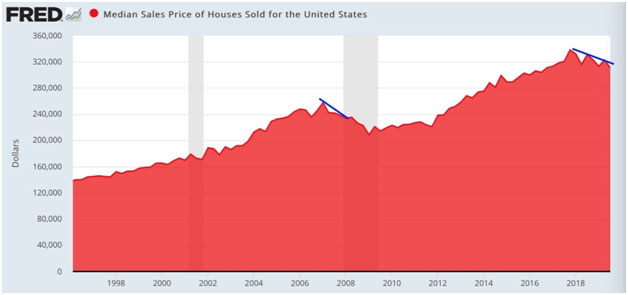

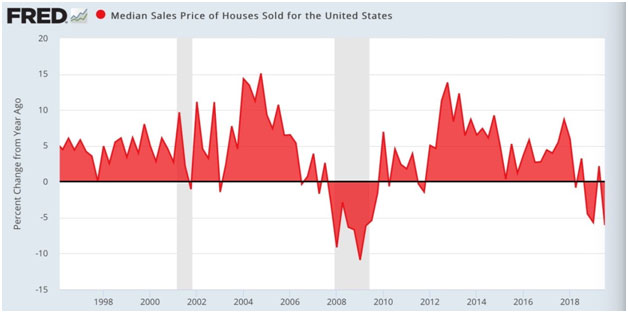

According to the Federal Reserve Economic Data (FRED), the median sales price of houses sold in the United States began softening in 2017. Therefore, we’ve already had some pricing deflation let out of the system.

If we look what happened after the previous peak in late 2006, we saw the median sales price go from $255,000 down to $210,000 (-17%) over the course of 2.5 years. Sometime in 2H2009, home prices bottomed.

Home prices gradually ticked higher from late 2009 until 2012, before exploding ~55% higher from $220,000 to $340,000 in 2H2017.

The median sales price has since fallen from $340,000 to roughly $310,000 in 4Q2019, a 9% decline. With prices down and mortgage rates down, affordability is up.

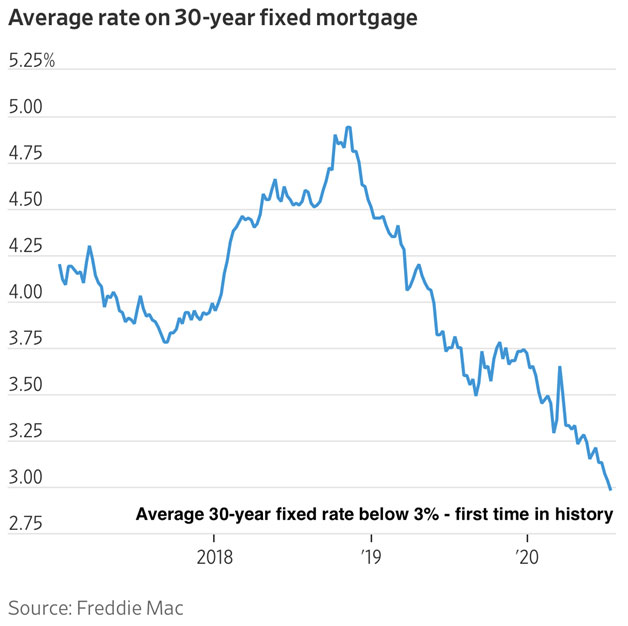

2. Mortgage rates have collapsed.

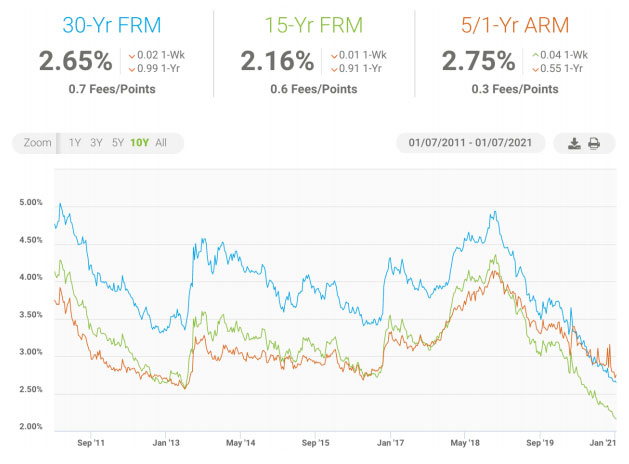

Mortgage rates have declined by over 1% across various mortgage types since their highs in 2018. The average mortgage rate for a 30-year fixed is now below 3%, which is unheard of.

3. The stock market is at an all-time high.

The S&P 500 closed 2019 up an incredible 31%. In 2020, the S&P 500 and the NASDAQ have rebounded to all-time highs after a tough March 2020. As a result, stocks investors are extremely wealthy, especially tech investors.

So much wealth has been created in the stock market that it is inevitable some of that wealth will move to real estate, which lagged in 2019. The tradition of turning “funny money” into real assets will continue, especially now. We all want to feel a sense of normalcy. And owning a home or a larger and nicer home helps.

At the same time, we’re also looking to invest for a profit. Given real estate prices moves more slowly than stocks, we’re looking to diversify into 18-hour cities across the heartland of America.

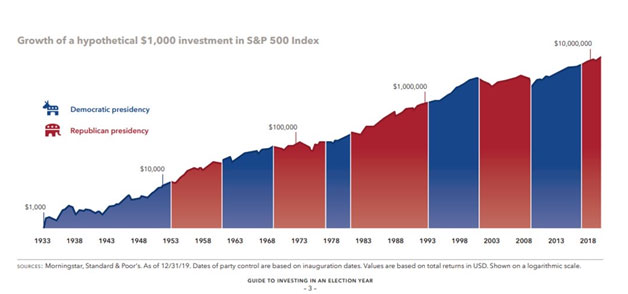

4. 2020 was a presidential election year.

If we know one thing about power-hungry politicians, it’s that in order to stay in power, they will do everything possible to help ensure the economy keeps growing.

The stock market and the real estate market tend to get hyped up over all the promises the presidential

candidates promise to get elected. The thing is, regardless of who wins, the stock market and real estate

market tend to do well.

5. The devil you know is better than the devil you don’t.

Once the state income and property tax deduction limit of $10,000 was introduced and the mortgage interest deduction limit was lowered from $1,000,000 to $750,000 for 2018, there was a lot of uncertainty regarding how this would affect a homeowner’s tax bill. Now that homeowners have gotten to see what the exact damage is, homeowners and tax experts can now make more calculated home ownership decisions going forward.

The SALT cap limit hasn’t hurt as badly as some people feared due to the doubling of the standard deduction and the decline in mortgage rates.

6. Rents continue to tick up.

The value of a property is ultimately based on its rental income. Some coastal cities will have lower cap

rates due to faster property price appreciation. While heartland cities will have higher cap rates, which

offer tremendous value to income-seeking investors.

With the corona virus pandemic, there is shelter-in-place for millions. However, thanks to stimulus checks, generous unemployment benefits by state, and the Paychecks Protection Program, I’m confident that many Americans will survive the lock downs and keep paying rent. In some states, you can earn $5,000+ a month in unemployment benefits.

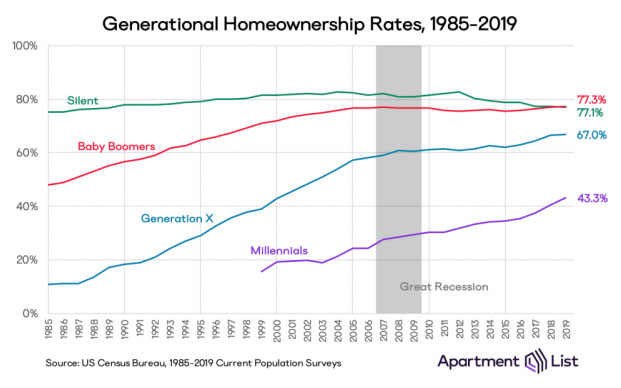

7. The Millennial generation is in its prime buying years.

Millennials are now mostly in their 30s, which means they’ve had 10+ years to save for a down payment. They’re also at a stage where they are settling down and having children.

There’s probably no bigger catalyst to own a property than children. Your nesting instincts go into overdrive as you strive for stability. Further, there is probably no bigger multi-year catalyst to invest in real estate due to demand coming from millennials.

Millennials today account for almost 40% of homebuyers.

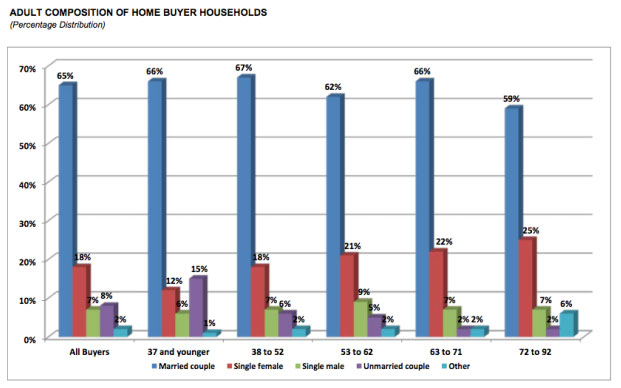

Adult Composition of Home Buyer Households

You can see from the chart below by the National Association of Realtors®Home Buyer and Seller Generational Trends study that married couples dominate the home buyer demographic, followed by single females. No surprise, the single male is way behind the single female when it comes to home buying.

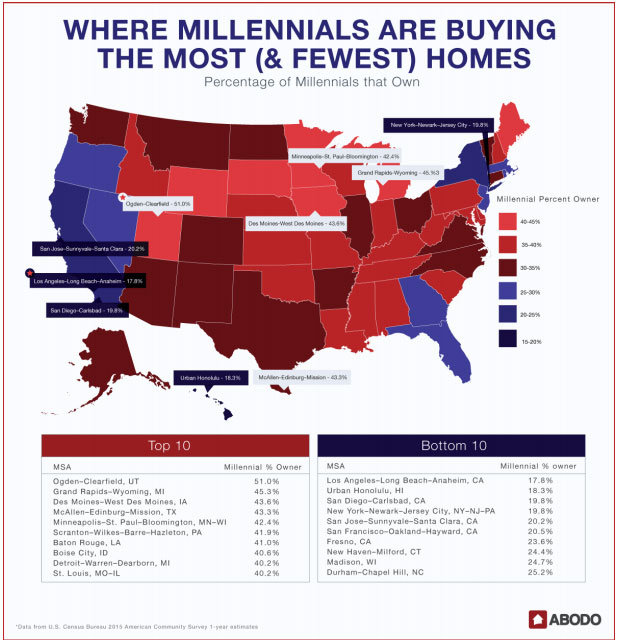

Below is another interesting graphic that shows where millennials are buying the most homes. They certainly aren’t buying as many homes in California or Washington, Hawaii, Florida, New York, New Jersey, Washington D.C. or Boston.

This buying trend gives confidence that buying property in non-coastal cities is a good long-term trend.

Just like how stock investors shouldn’t fight the Fed, real estate investors shouldn’t fight multi-decade

demographic trends.

Google is spending $13 billion on real estate in Nevada, Ohio, Texas, and Nebraska in 2019 and beyond. Uber signed a 450,000-square-foot lease within The Epic, a mixed-use development in Dallas, Texas. Their office is set to open in 2022. The trend towards the heartland is as clear as day.

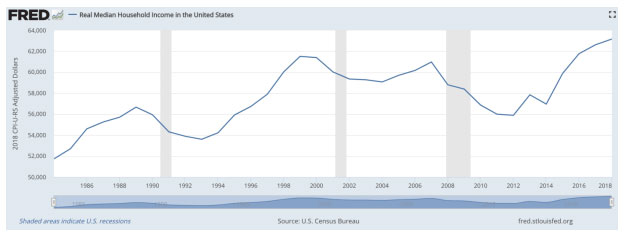

8. Wage growth is reaching new highs.

Real median household income finally broke out to new all-time highs in 2017. The latest data is $63,179 at the end of 2018. I’m confident when the 2019 data comes out in 2020, the real median household income will go up further.

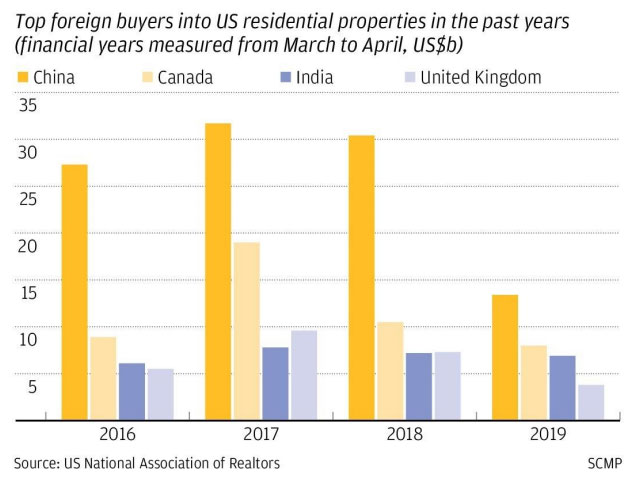

9. Hot foreign money has cooled off.

Before 2017, a lot of coastal city buyers had to compete with wealthy foreign money, especially from

China. Foreign buyers caused bidding wars and a lot of competition for potential local buyers. The

Chinese government has since clamped down on hot money outflow to purchase foreign property. As a

result, Chinese buyers of U.S. real estate is down over 50% YoY in 2019.

Now with corona virus fears in 2020, you know that the wealthy Chinese are trying to do everything they

can to diversify away from the Chinese economy.

From a foreign capital competition perspective, the time to buy is when their spigots have been shut off.

Eventually, foreign money will come flooding into America again, especially if there is a resolution with

the trade war. There has been over two years of pent up demand for U.S. property. When the demand is

finally unleashed, it will probably result in all-cash bidding wars once again.

10. V-shaped economic recovery.

During the 2008-2009 financial crisis, the median home price in America declined by ~17% over a 2.5year period. Most economists do not believe we will go through a downturn of a similar magnitude because lending standards have been so incredibly tight post the 2008-2009 recession

Since 2009, only people with excellent credit scores have been able to get mortgages. Negative amortizing liar loans have disappeared. It has also become common practice to buy a home with a 20% or greater down payment again.

With so much home equity that has been accumulated since 2009 by very creditworthy borrowers, most homeowners should be able to weather a financial crisis much easier than in the past.

Since its late-2016 peak, the median sales price in America is already down ~9%. Even if home prices continue to decline and reach the same magnitude as the previous recession, there’s only 8% left to go.

The self-inflicted recession of 2020 to combat the coronavirus means that the recovery should be much quicker since we have the power to open up the economy. This recession is very different from the last one, which took years to unwind over-leverage in the system.

11. Conforming loan limits are going up.

The Federal Housing Finance Agency (FHFA) announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2020. In most of the U.S., the 2020 maximum conforming loan limit for one-unit properties will be $510,400, an increase from $484,350 in 2019.

In high-cost areas, the maximum loan limit for mortgages acquired by Fannie Mae and Freddie Mac will be $765,600. Higher conforming loan limits means homebuyers are able to buy more house at the same conforming loan rate.

Further, higher limits signify the government recognizes real estate prices have room for upside, as their loan limits follow inflation. Therefore, even the government thinks it’s time to buy real estate during the pandemic.

Is 2021 The Perfect Time To Invest In Property?

Do you want to invest in property? We saw tremendous stock market growth in 2019 with the S&P 500 up 31% follows by another 18% in 2020 in the S&P 500. Most investors made money hand-over-fist, and we were swimming in cash. Just think about all the tech investors in the SF Bay Area after the NASDAQ closed up 44% in 2020!

Despite a strong stock market, the physical real estate market lagged behind. This is why I think there is

tremendous opportunity to buy real estate in 2021 and beyond. Affordability is up because mortgage

rates are down to ALL-TIME lows.

Millennials are coming of buying age and inventory is on the decline, making competition for homes quite high. I’ve talked to over 30 28-35-year-olds who all say they want to buy.

That said, it’s always good to be cautious before buying property. Here are some things to be aware of:

Things to Know Before Buying Property in 2021

1. Falling rents. If you want to invest in property it’s important to pay attention to rental prices. Given property prices are a function of rental income multiples, a real estate buyer should be looking to buy at similar pricing discounts from peak rental periods.

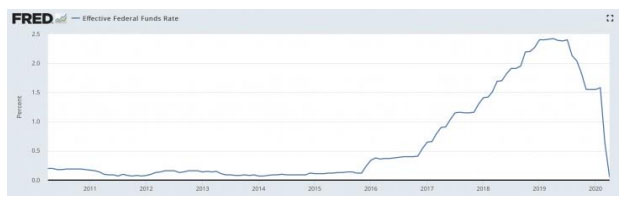

2. The Fed is on your side. Pay attention to interest rates if you want to invest in property. After raising

rates multiple times since end of 2015, the Fed has finally reversed course, creating a nice tailwind for

homebuyers. Look at the dramatic drop-in rates in 2020.

The Fed has promised to keep rates at 0% – 0.25% infinitely. It’s happy to wait for the economy to

recover from the pandemic and see higher-than-normal 2% inflation.

Fed Funds Rate

In 2021, you can get a 7/1 jumbo ARM for 2.5% or less with minimal fees. It’s nuts! Take a look at the mortgage rate chart below to see for yourself.

3. Property prices are higher than 2006 peak prices.

While every city is different, if you look at the prices in Denver and Dallas, you’ll find that the prices are

roughly 45% higher than they were in 2006-2007. This price performance is similar to San Francisco’s.

Meanwhile, hot cities like Seattle and Portland are only about 20% above previous peaks. Make sure you pay attention to fundamentals.

San Francisco still has tremendous job growth and income growth. The NASDAQ is back to its all-time high in 2021 after a scary decline in March 2020.

4. Housing prices will eventually affect tax returns, but not immediately.

Limiting state income and property tax deductions to $10,000 and limiting mortgage interest deductions on new mortgages up to $750,000 are net negatives for expensive coastal city real estate markets.

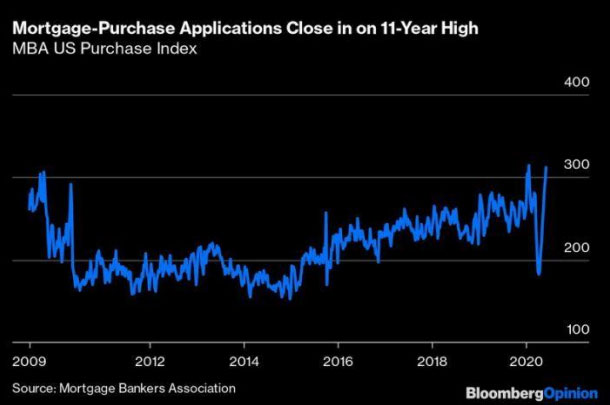

5. Mortgage-purchase applications close to a 11-year high.

There is pent up demand to buy property during the shutdown. This could bring about the mother of all bidding wars due to low rates and low supply.

6. Real estate is a laggard to stocks.

The housing boom that began in January 1996 ended in March 2006. But it wasn’t until the beginning of 2008 that people started to accept that the housing market had already peaked.

Until 2008, property investors were still clinging to hope or at least were in denial that prices would no longer be going up. Once Bear Sterns was sold for nothing to JP Morgan in March 2008, people started to panic.

Then, Lehman Brothers went under on September 15, 2008, a full two and a half years after the housing market peaked. And things got even worse, with the S&P 500 finally bottoming out on March 9, 2009.

Below is a great chart that shows how badly housing prices corrected historically in some of our major cities. Notice how the previous boom lasted 10 years and the crash lasted 5 years. We’re now going into the 8th year of a bull market.

In 2020, the situation is a little different because of how quickly the stock market declined in March and

then rebounded. There’s a window of opportunity to buy real estate from those who still think we’re heading off a cliff.

The Fed and the government have explicitly said they will support the economy no matter what in 2021+.

Invest in Property In 2021

The mass media and the real estate industry will focus on strong demand, strong job growth, and a

dearth of inventory as drivers for higher property prices in 2020 and beyond.

That’s fine if you can surgically buy in strong job cities via real estate crowdfunding. But, don’t count on

that being the rule.

Look at property nationwide as a whole before you invest in a property. Prices will probably continue to

inch up due to a slowing in new home construction.

Look at real estate opportunities in your own city as there will be a migration to lower cost areas of your

city with more space and less density. The work from home trend will ensure this as fewer people need

to commute downtown anymore.

Dying to buy a primary residence? Ensure that you can withstand a 20%+ correction over a five-year timeframe.

If you don’t have a financial buffer equal to at least 10% of the value of your property after putting down

20%+, then you are not financially prepared for a downturn.

As published 01/14/2021 by Financial Samurai

A golden opportunity to buy real estate during the pandemic is upon us. With mortgage rates falling to all-time lows, the S&P 500 at all-time highs, and a lot of people still fearful, chances are higher you can get a better real estate deal.

Everyone is spending more time at home now. Therefore, the intrinsic value of a home has gone way up. People are looking to buy larger homes with more amenities. Demand for remodeling is through the roof! Yet, given mortgage rates have collapsed, affordability is up.

With the mass media hyping up the demographic shift away from big cities to small cities, it’s time for the savvy investor to go the other way and focus on big city real estate again.

That said, secondary cities, also called 18-hour cities are also very attractive given lower valuations, higher net rental yields, and less overall density.

Let me explain in more detail why I believe now is the time to buy real estate in again for 2021 and beyond.

Amalfi Capital is a real estate equity firm founded in 2015 that is an investor in over 1 million square feet of property with a gross value over $125 million throughout the United States. Amalfi focuses on expanding its portfolio by acquiring residential, commercial, & industrial assets that we believe are well positioned for above market returns over the long run. AmalfiCapitalinfo@gmail.com